Renters Insurance in and around St. John

St. John renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- St. John

- Saint John

- Dyer

- Cedar Lake

- Schererville

- Crown Point

- Lowell

- Crete

- Beecher

- Lake County, IN

Home Is Where Your Heart Is

Renting a home comes with plenty of worries. You want to make sure what you own is protected in the event of some unexpected accident or damage. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Ryan Spangler is ready to help you handle the unexpected with high-quality coverage for your renters insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Ryan Spangler can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

St. John renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

When the unanticipated break-in happens to your rented townhome or space, often it affects your personal belongings, such as sports equipment, a video game system or a coffee maker. That's where your renters insurance comes in. State Farm agent Ryan Spangler wants to help you evaluate your risks so that you can keep your things safe.

It's never a bad idea to make sure you're prepared. Reach out to State Farm agent Ryan Spangler for help learning more about coverage options for your rented space.

Have More Questions About Renters Insurance?

Call Ryan at (219) 627-3996 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

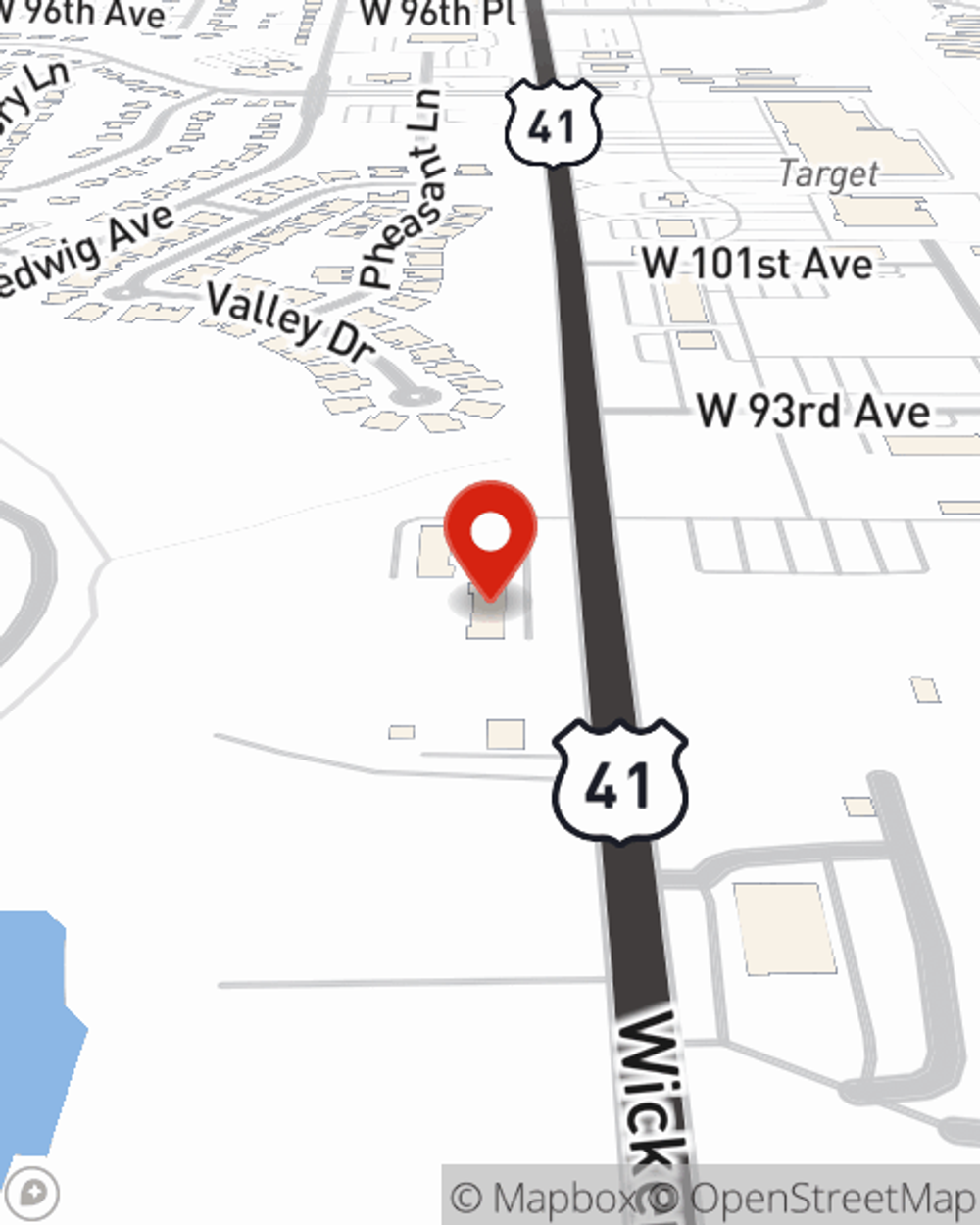

Ryan Spangler

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.