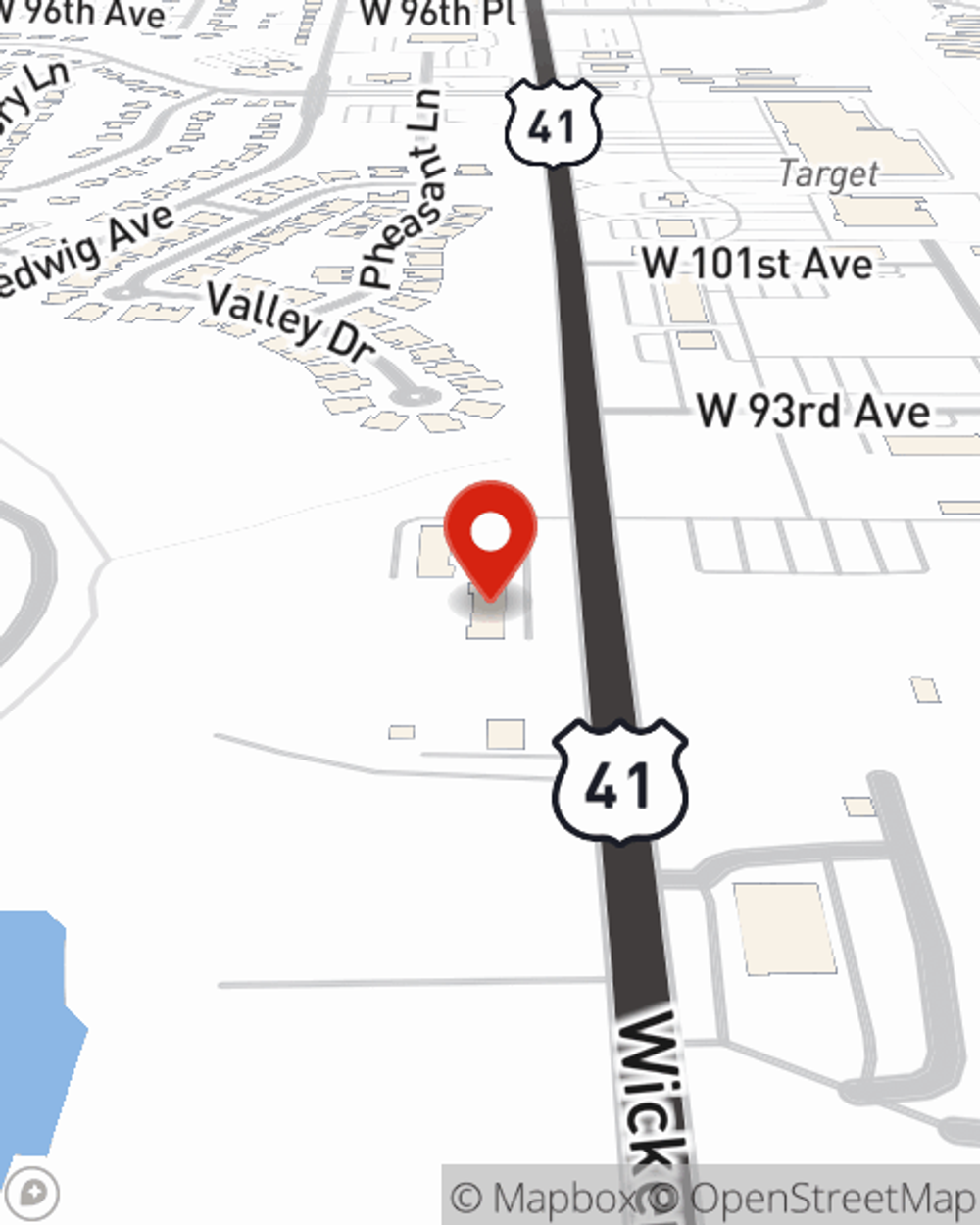

Insurance in and around St. John

A variety of coverage options to help meet your needs

Insurance that works for you

Would you like to create a personalized quote?

- St. John

- Saint John

- Dyer

- Cedar Lake

- Schererville

- Crown Point

- Lowell

- Crete

- Beecher

- Lake County, IN

100 Years Of Good Neighboring Experience

State Farm understands the need to protect what's important to you and has developed a collection of insurance products with personalized pricing plans to help protect what you've built. From vehicle and motorcycle insurance that protects your ride, to your boat, motorhome, RV, and off-road ATV, State Farm has competitive prices and easy claims to help you protect them all. Contact Ryan Spangler for a Personalized Price Plan.

A variety of coverage options to help meet your needs

Insurance that works for you

Got A Plan? Let Us Help You Get There

But your automobile is just one of the many insurance products where State Farm and Ryan Spangler can help. Do you operate a business in the St. John area or want to be your own boss? Navigating the complicated world of small business insurance? Ryan Spangler can make it easy to find the insurance you need to protect what you’ve worked so hard to achieve. And we also offer a number of liability insurance options to guard the ones you love in the event of an illness or injury.

Simple Insights®

Boating safety tips

Boating safety tips

Before you set sail and venture into the open waters, learn the essentials of boat safety.

How long to keep documents before shredding

How long to keep documents before shredding

Do you know how long to keep tax records, bank statements, utility bills and other important documents? State Farm has suggestions to help.

Ryan Spangler

State Farm® Insurance AgentSimple Insights®

Boating safety tips

Boating safety tips

Before you set sail and venture into the open waters, learn the essentials of boat safety.

How long to keep documents before shredding

How long to keep documents before shredding

Do you know how long to keep tax records, bank statements, utility bills and other important documents? State Farm has suggestions to help.